Colorado Gas Tax 2024. The colorado legislature has expanded its floor calendars and plans fast agendas as it works to pass legislation on housing, gun. Colorado offers an automatic six.

We’re not huge fans of the. Coloradans will pay 54 cents more per gallon of gas starting in 2023.

$1.637 Billion Would Go Toward The State Share Of Colorado’s Highway Users Tax Fund, Which Is The Existing.

Colorado gas tax is $0.22 per gallon, which is put towards critical avalanche control on vital roads, as well as traditional infrastructure maintenance and construction.

⁴ Ers Is Charged On Gasoline And Special Fuel Including Dyed Special Fuel, But Is Not Charged On.

As part of the compromise, producers will get hit with a fee that fluctuates with market prices on every barrel of oil produced in the state.

Here’s How The $4 Billion Would Be Spent:

Images References :

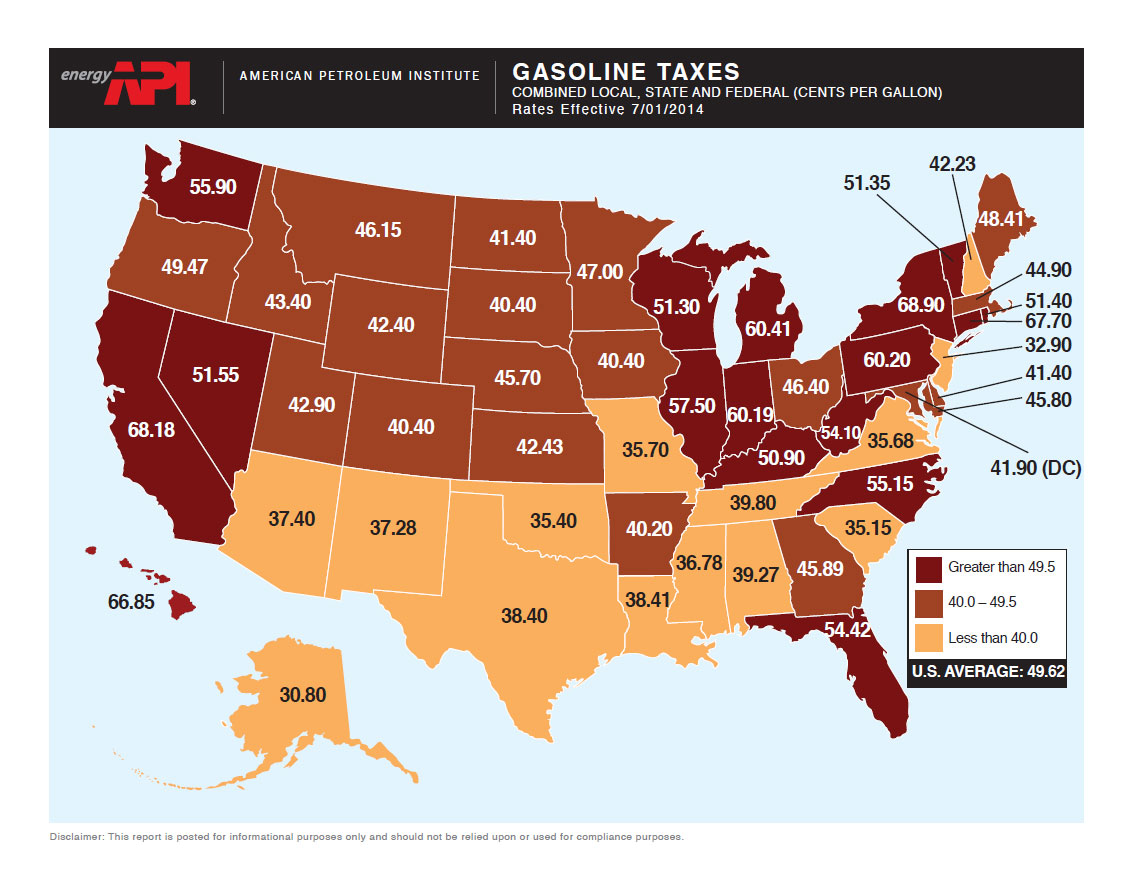

Source: www.statista.com

Source: www.statista.com

Chart 12 U.S. States Are Boosting Their Gasoline Tax Today Statista, Rebates from the inflation reduction act are not currently available. As colorado moves towards strategically outlining its fiscal initiatives for the year 2024, it is critical to ensure that its citizens, the taxpayers,.

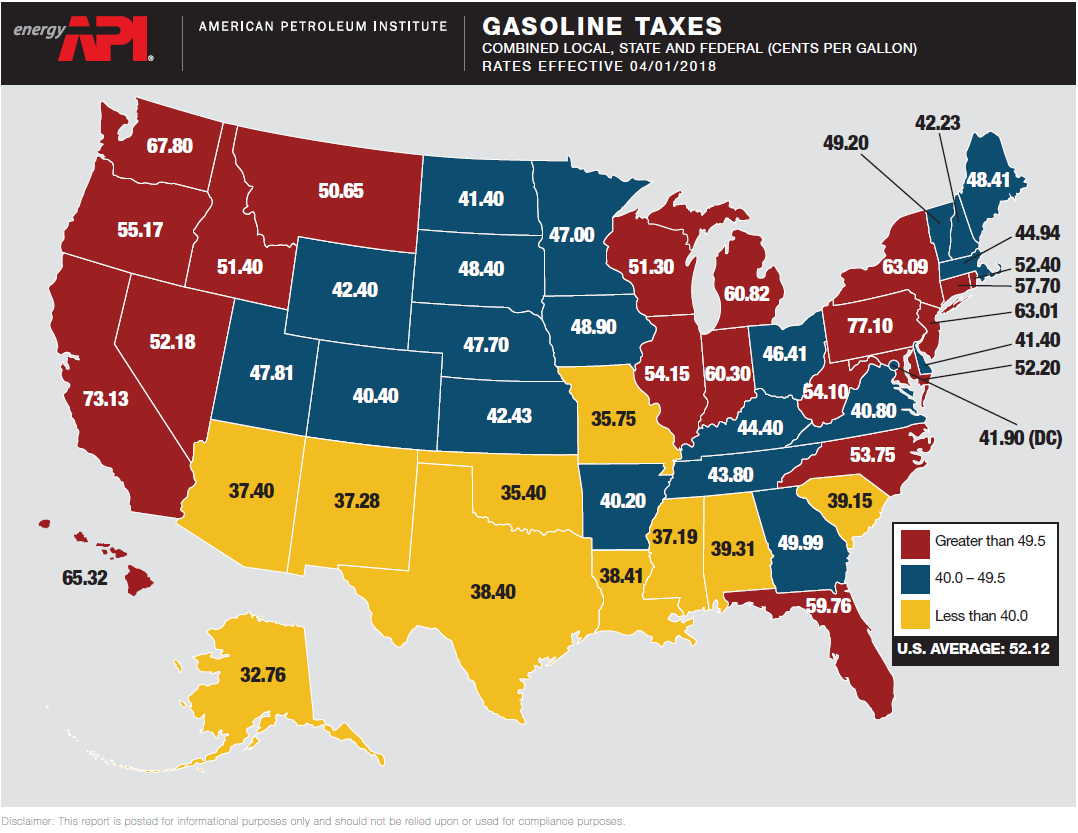

Source: time.com

Source: time.com

This Map Shows Where Gas is Taxed the Most TIME, We expect it will be 2025 before the federal rebate funds will be available to colorado residents. Requires the pera board by june 1, 2024, to adopt proxy voting procedures that “ensure that the board’s voting decisions align with, and are supportive of, the statewide greenhouse gas emission reduction goals.” adds wastewater thermal energy to the definition of “clean heat resource.”

Source: www.guttmanenergy.com

Source: www.guttmanenergy.com

State and Federal Gas Tax What is it? When did it start? Why?, Coloradans will pay 54 cents more per gallon of gas starting in 2023. We expect it will be 2025 before the federal rebate funds will be available to colorado residents.

Source: www.cpr.org

Source: www.cpr.org

Colorado gas prices hit record high of 4.11 a gallon and keep climbing, May 2, 2024 at 10:52 a.m. Gas prices have receded from the historic high reached this summer, but some social media users are claiming.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Map State Gasoline Tax Rates, Fuel tax and fee rates. We’re not huge fans of the.

Source: www.cheatsheet.com

Source: www.cheatsheet.com

Here's How Gasoline Taxes Stack Up State By State, Heat pumps are a highly. May 2, 2024 at 10:52 a.m.

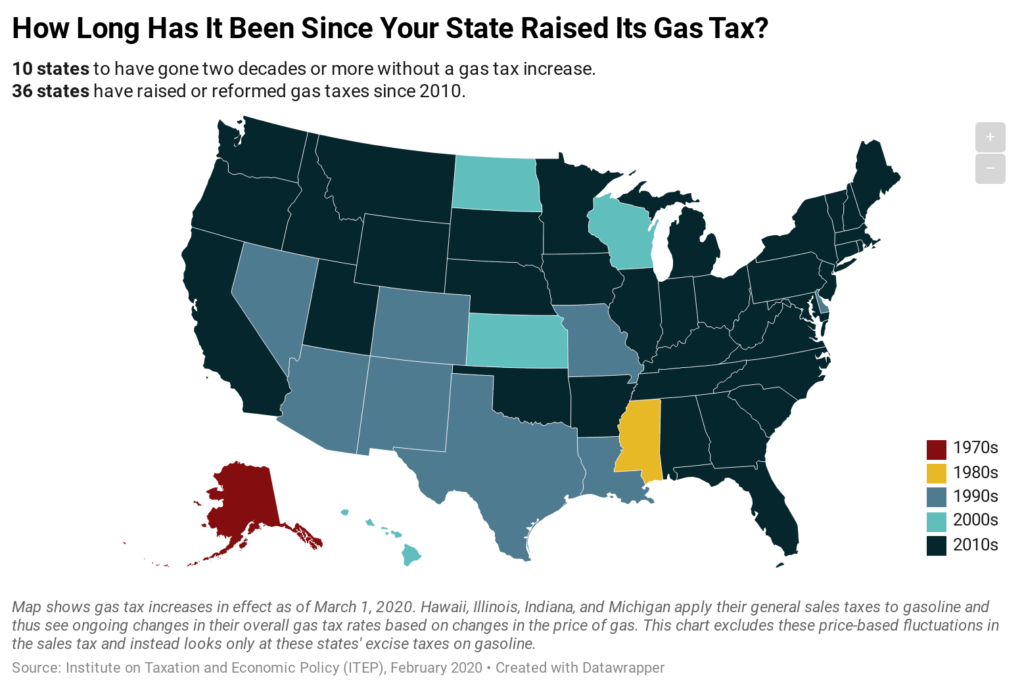

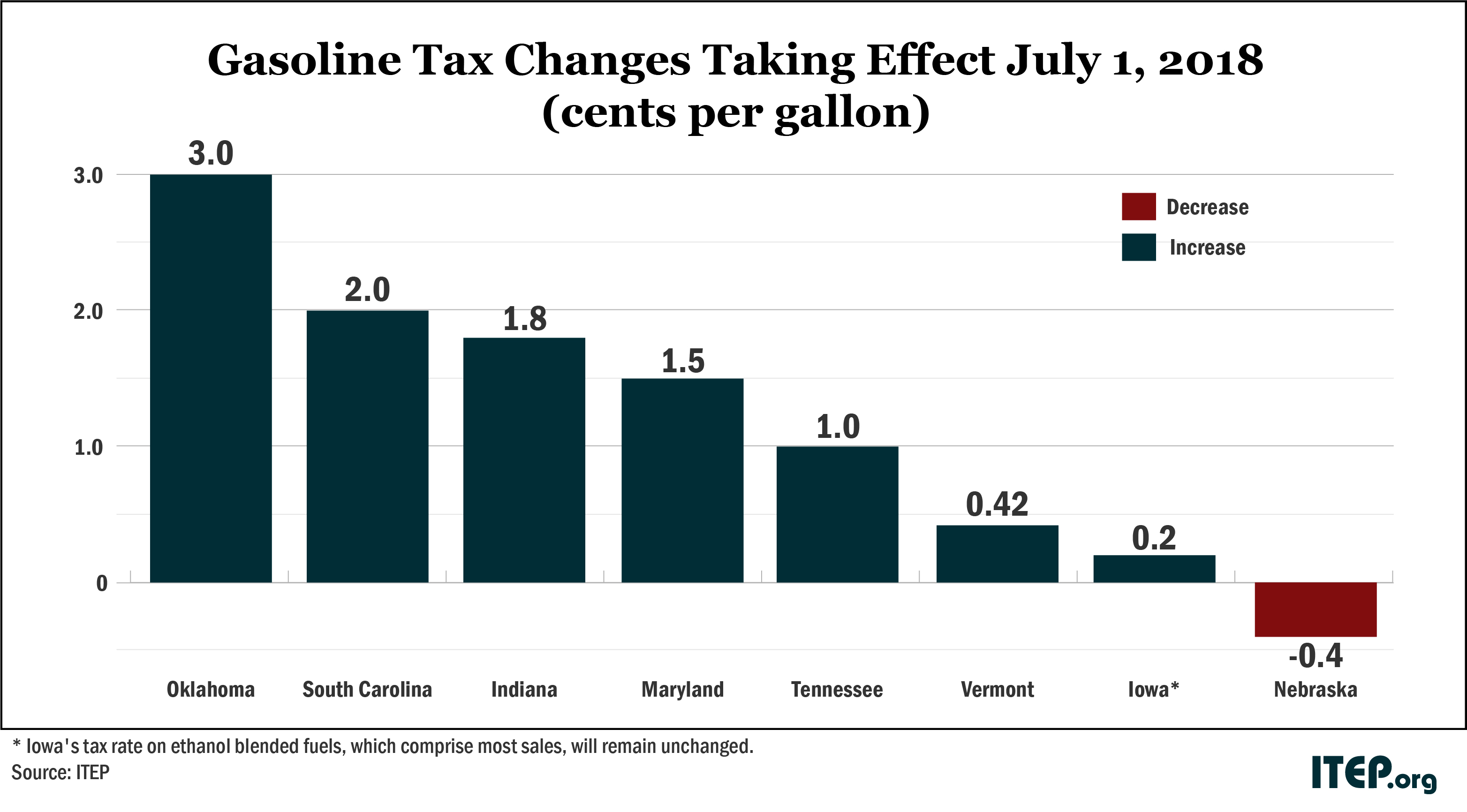

Source: itep.org

Source: itep.org

How Long Has It Been Since Your State Raised Its Gas Tax? ITEP, Industrial facilities (see eligibility section below) amount: As colorado moves towards strategically outlining its fiscal initiatives for the year 2024, it is critical to ensure that its citizens, the taxpayers,.

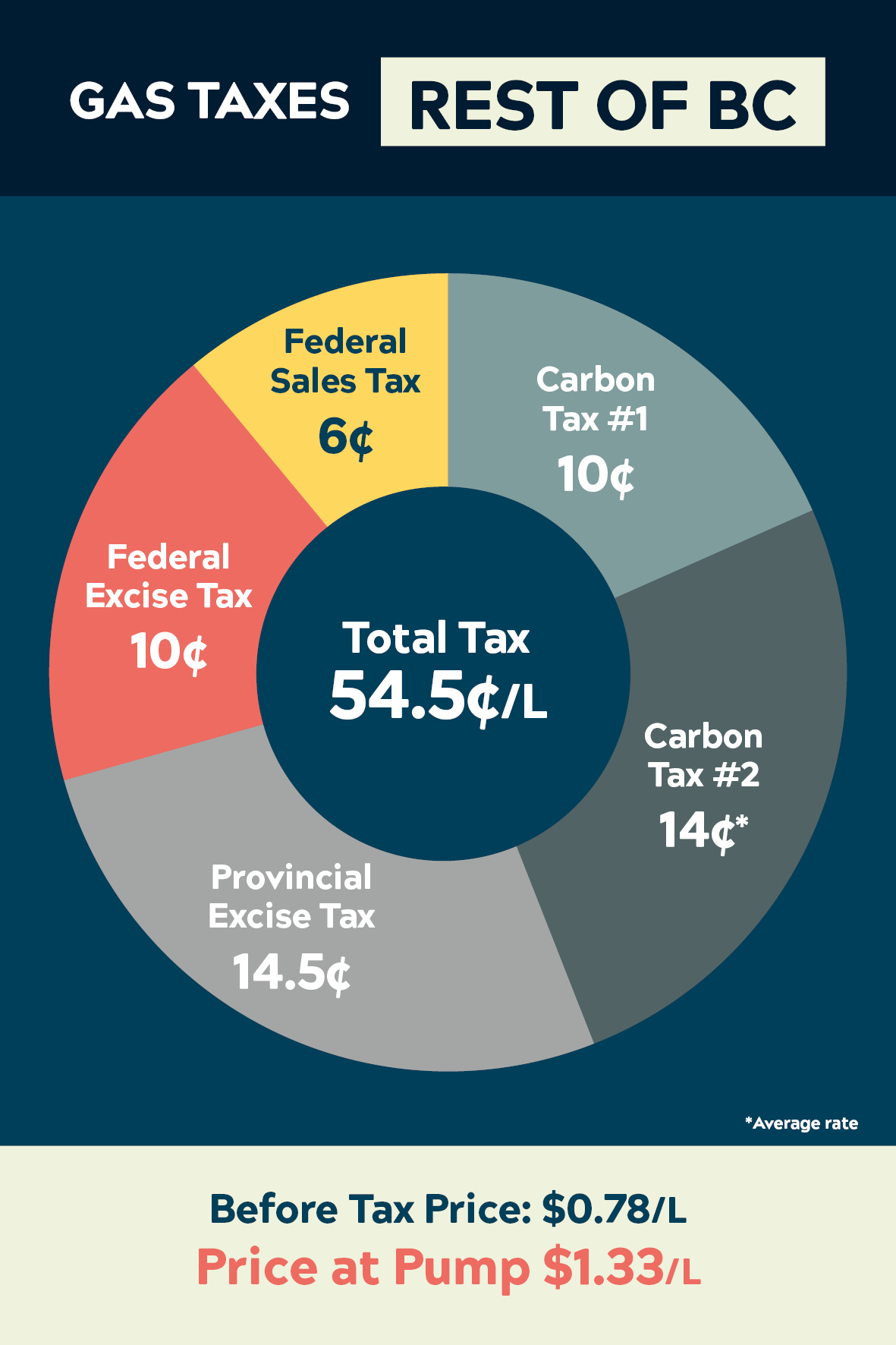

Source: fraservalleynewsnetwork.com

Source: fraservalleynewsnetwork.com

OPINION Taxes a Big Part of High Gasoline Prices Taxpayers, December 21, 202317 min read by: Thanks to a new law that went into effect on jan.

Source: itep.org

Source: itep.org

Gas Taxes Rise in Seven States, Including an Historic Increase in, Today’s map shows state gas tax rates as of july 2023. 4:01 pm mdt on apr 26, 2024.

Source: www.instituteforenergyresearch.org

Source: www.instituteforenergyresearch.org

Some States Consider Raising Gasoline Taxes IER, In the united states, the federal motor fuel tax rates are gasoline tax: Industrial facilities (see eligibility section below) amount:

Coloradans Will Pay 54 Cents More Per Gallon Of Gas Starting In 2023.

² government sales are not exempt from these fees.

Starting January 1, 2024, Coloradans Can Take Advantage Of Tax Credits To Install Heat Pumps For Space Heating And Cooling And Water Heating.

Colorado energy office anticipates applying for the funds in spring 2024.